The Quest for Quality Carbon Credits: A Guide for Sustainability Professionals

Part 1 : Understanding the difference between carbon certifications companies like VCS and ratings agencies like Calyx Global

In the journey toward sustainability, many companies are pledging to achieve net-zero emissions, setting ambitious targets that often reach into the next decade or beyond. For instance, a company aiming for net-zero by 2035 faces a complex challenge, especially when it comes to offsetting unavoidable emissions through the purchase of quality carbon credits. Understanding where to start in this intricate market is crucial, and here’s how you can navigate this terrain effectively.

Understanding the Carbon Credit Landscape

Carbon credits are a key tool for businesses to offset their carbon footprint. Each credit represents a ton of CO2 either removed from the atmosphere or prevented from being emitted. However, the quality of these credits can vary significantly, making it essential to identify and invest in those that offer genuine environmental benefits that would have not been made otherwise.

The Role of Certification Standards

Central to ensuring the quality of carbon credits are certification bodies like the Verified Carbon Standard (VCS) by Verra and the Gold Standard. These organizations establish criteria for carbon offset projects, ensuring that each credit represents a real, measurable, and additional reduction or removal of carbon emissions. The Gold Standard goes a step further by also assessing the social benefits of projects, aligning closely with Sustainable Development Goals (SDGs). But this should not be your ultimate stop when you are looking for quality carbon credits.

The Emergence of Carbon Credit Ratings: Calyx Global

While certification standards verify the compliance of projects with certain environmental and social criteria, navigating the complex market of carbon credits requires a deeper analysis of project quality and impact. This is where Calyx Global steps in. Unlike VCS and Gold Standard, which focus on certifying projects, Calyx Global serves as a carbon credit ratings agency, providing a critical assessment of carbon credit projects across multiple dimensions.

Calyx Global evaluates projects based on their greenhouse gas (GHG) claim integrity, their contribution to SDGs, and their environmental and social risk profile. This nuanced analysis includes assessing the additionality, permanence, and risk of over-crediting of carbon credits, offering an independent and rigorous review that goes beyond basic certification. By doing so, Calyx Global helps buyers identify high-quality credits that align with their sustainability goals and risk tolerance.

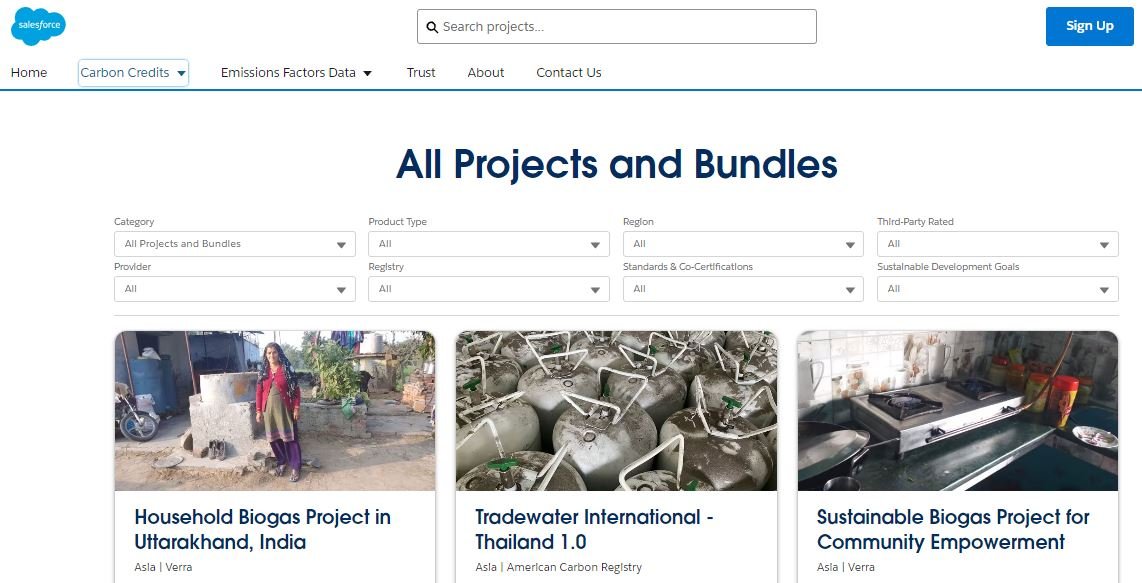

Leveraging Marketplaces: The Salesforce Example

To streamline the process of acquiring quality carbon credits, companies are increasingly turning to digital marketplaces. A notable example is Salesforce’s carbon credit marketplace, which utilizes the expertise of ratings agencies like Calyx Global to rate and validate the carbon credits available on its platform. This partnership ensures that buyers have access to a selection of credits that have been rigorously assessed for their environmental and social impact, making it easier for companies to make informed decisions that align with their sustainability commitments.

Final Thoughts

The path to net-zero brings with it many challenges, but by leveraging the expertise of certification bodies and ratings agencies, companies can navigate the carbon credit market with greater confidence. Understanding the roles of entities like VCS, Gold Standard, and Calyx Global, and utilizing resources like Salesforce’s marketplace, are critical steps in ensuring that your investments in carbon credits drive genuine environmental benefits and support your sustainability objectives. As we move forward, the collaboration between these organizations will continue to play a pivotal role in the development of a transparent, credible, and effective carbon market.

Continue to read our series geared towards sustainability professionals who are either just starting their journey of understanding or those of us who would like a refresher on all the “ins and outs” of purchasing quality carbon credits. Check out more on our “News” page.